(i) How likely is the product to achieve critical mass?Īll these are certainly sensible questions in evaluating an investment into cryptoassets. (h) How transparent is the management team? and (g) How will investors see a return on investments?

(b) What is the proposed solution to the problem? (a) What is the problem the cryptoasset is addressing? They propose that in evaluating an investment, the trustees need to consider inter alia the following questions: 1 AF Streisand & JD Rees, “Cryptocurrencies and Trustees Duties to Invest Prudently: Navigating Fiduciary Duties in the Age of Decentralization” (2018) 24(3) California Trusts and Estates Quarterly 11 at 20. Here at HTJ Tax, we typically handle 6,7 and 8 figure individuals and companies who engage in the business of cryptoassets, and we can do no better than adopting Rees and Streisand (when we speak to our clients), they suggest that a deep dive on a particular cryptoasset investment being considered needs to be undertaken. There is typically a dearth of case law in respect of the tax treatment of crypto either at the state or federal levels however we have collated a list of recent regulatory decisions and court decisions to assist. Gain or loss from a convertible virtual currency transaction may be ordinary income or loss if the taxpayer is considered to be a dealer in the virtual currency (for example, if the virtual currency is considered part of the taxpayer’s inventory, see IRC Section 1221(a)(1)). The character of any gain or loss on the exchange of convertible virtual currency depends on whether the virtual currency is a capital asset in the hands of the taxpayer, which will generally be the case for a taxpayer that invests in or trades virtual currency.

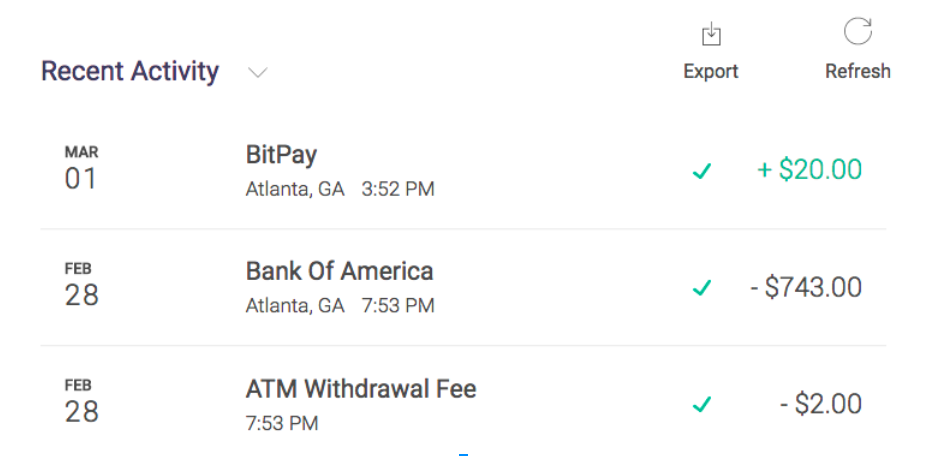

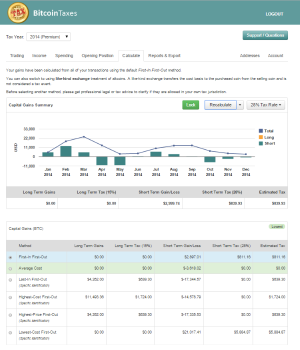

For example, using Bitcoin to buy a sandwich could trigger taxable gain or loss. Using the convertible virtual currency to buy other property.This can include, for example, virtual currency paid by an employer to an employee as wages (with wages subject to income tax withholding and payroll taxes). In computing gross income from the payment, the recipient must include the fair market value of the virtual currency, measured in US dollars, on the date of payment. Receipt of convertible virtual currency as payment for goods or services.Transactions in convertible virtual currency can generate gain or loss for US tax purposes.Įxamples of transactions in convertible virtual currency that can generate income, gain, or loss include:.This means that the rules that apply to foreign currencies (and that can cause foreign currency gain or loss for US tax purposes from transactions in foreign currencies) do not apply. Convertible virtual currency is treated as property (and not currency).Like other jurisdictions the IRS defines virtual currency as a digital representation of value (other than a representation of the US dollar or a foreign currency) that functions as a unit of account, store of value, and a medium of exchange. The IRS published initial guidance on the taxation of transactions using virtual currency in IRS Notice 2014-21 ( so over 8 years ago, this means that a majority of taxable actions involving digital assets will incur capital gains tax treatment, similar to how stocks are taxed), this is still the position. 24 and the April 18 deadline, with penalties issued for submissions made beyond the deadline.Ĭryptocurrencies, including non-fungible tokens (NFTs), continue to be treated as “property” for the purposes of tax in the United States. Taxpayers can file their taxes between Jan. citizen that dabbled in cryptocurrency over the 2021 tax year will now be expected to file a tax return to the IRS.

0 kommentar(er)

0 kommentar(er)